PVB Ranked Again in Top 5 Strongest Mid-sized Banks in Kansas City

April 01, 2016

James Dornbrook

Reporter

Kansas City Business Journal

It’s no surprise that Kansas City’s strong middle market economy would have a great selection of midsize banks to choose from. Both big enough to offer lots of services, but small enough to give personal attention to its clients.

But which Kansas City-area midsize banks are the strongest, and most likely to fill the needs of clients through whatever the economy throws at them?

We studied the year-end data posted by the Federal Deposit Insurance Corp. for 2015 to identify the strongest banks in the Kansas City area. We divided the banks into three categories:

• Small: less than $250 million in assets

• Midsize: $250 million to $1 billion in assets

• Large: more than $1 billion in assets

This story ranks the strongest banks in the midsize category. Previously we ranked the strongest large banks and a future story will rank the strongest small banks.

We determined the rankings using five categories, in the following order of significance:

Problem loan ratio shows the percentage of loans in a bank’s portfolio that are 90 days past due or no longer are accruing interest at the stated rate. The more problem loans a bank accrues, the weaker it becomes.

Texas ratio measures the credit problems of a bank. It is determined by adding up the problem loans and dividing them by a bank’s equity capital and loan-loss reserves. If a bank has a Texas ratio that exceeds 100 percent, it’s in serious jeopardy of being shut down by regulators.

Core capital ratio measures the amount of reserves a bank sets aside. Banks are required to hold a minimum of 6.5 percent core capital in reserve to be considered well capitalized by regulators. The more core capital a bank has, the better it can handle problems.

Equity capital is capital set aside that is free of debt and available to be used in the interest of the business.

Total loans and leases were used to help separate banks with similar numbers, giving more emphasis to the banks with larger portfolios. The more loans a bank has, the more impressive it makes a low problem loan ratio.

Honorable mentions

With so many banks in the area posting strong numbers and only five slots available, some difficult choices were made. A few banks were knocked out of contention for the top five, but are still worthy of an honorable mention.

Morrill & Jane's Bank & Trust Co. ( previously an honorable mention) and Citizens Bank & Trust Co. (previously unranked) are both very strong banks with commendable numbers. However, their reserve and equity capital didn't match up with the leaders and their Texas ratios, while incredibly solid, were over 1 percent while the top five were under that benchmark.

PREVIOUS RANKING: The five strongest midsize banks in Kansas City (mid-year 2015)

The strongest banks

No. 5: Bank of Lee's Summit once again makes our top five, with only a 0.29 percent problem loan ratio in its $114.19 million portfolio. It has $300 million in assets and four branch offices in the Kansas City area. With $56.3 million in equity capital — almost half the size of its loan portfolio, this is a bank with plenty of room left for growth. (Previous: No. 1 at mid-year 2015)

No. 4: The Mission Bank has been slowly boosting its reserve capital over the last few years to the point where it now has a 16.24 percent core capital ratio — the largest of our top five. It combines those huge reserves with an incredibly strong loan portfolio worth $258.1 million with a minuscule 0.27 problem loan ratio, ensuring this bank has a bright future. (Previous: Honorable Mention at mid-year 2015)

No. 3: Central National Bank is a great comeback story after facing adversity during the Great Recession. It went above and beyond to fully address every concern raised by regulators and has been gaining strength ever since. It has been a regular in our Top Five and its strength hasn't wavered at all. It had the highest equity capital of the top five at $104.5 million, which is solid for a $938.1 million-asset bank. It's $104.52 million loan portfolio had only a 0.19 percent problem loan ratio. With abundant reserve capital, this bank continues to have a bright future. (Previous: No. 4 at mid-year 2015)

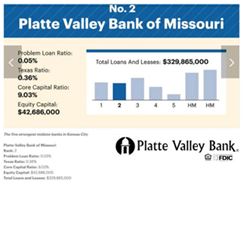

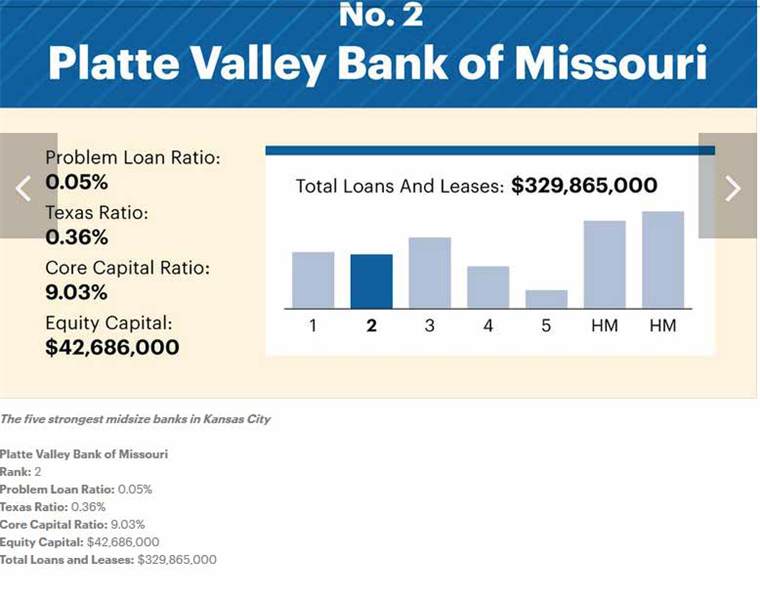

No. 2: Platte Valley Bank of Missouri is an independently chartered bank that is part of the Country Club Bank family. It had the lowest problem loan ratio and Texas ratio of all banks in the top five. It had a microscopic 0.05 percent problem ratio in a portfolio of $329.87 million. The bank combines a strong loan portfolio with plenty of dry powder for continued growth, evidenced by its $42.69 million in equity capital. (Previous: No. 5 at mid-year 2015)

No. 1: The strongest midsize bank in Kansas City for 2015 goes to BankLiberty, which recently converted from a thrift to a commercial bank. BankLiberty shot up the rankings quickly by posting a strong combination of a tiny 0.12 percent problem loan ratio in a $344.61 million portfolio, with a hefty core capital ratio of 10.64 and $49 million in equity capital. The $435.8 million-asset bank is poised well to capitalize on its position of strength. (Previous: Unlisted at mid-year 2015)